Tax Matters

Tax issues can be confusing and complicated, and tax laws are constantly changing. In order to remain in compliance with tax laws, reduce the chances of being audited, and utilize the tax code to the greatest advantage possible, businesses and individuals need the advice of a knowledgeable and professional tax attorney, preferably one with specialized training. McGrath & Spielberger, PLLC can assist clients in achieving their individual and business goals by minimizing risks, maximizing after-tax profits, and advising on day-to-day concerns which affect the bottom line. Click here to contact us about your tax matter.

Savvy business owners know that tax issues accompany every business decisions. Making such decisions requires a calculated and informed analysis. Our Tax Attorneys take a teamwork approach in working with our clients – learning and understanding their financial situations and goals and even their businesses and industries. This allows us to focus on providing beneficial advice which is relevant to the complex financial issues currently facing our clients as well as putting us in the best position to anticipate and plan for tomorrow’s challenges.

Our firm is available to represent individuals, businesses, non-profit organizations, trusts, estates, and other taxpayers in handling tax disputes and collection matters before the Internal Revenue Service or other state and local taxing authorities. Tax Attorney services are available to provide comprehensive and formal representation or offer limited scope services such as providing guidance and supporting analysis to clients who may choose to represent themselves (although we usually do not recommend representing yourself in a tax controversy!).

Our goal is to provide you with quality advice regarding your tax issues, and if you hire us to protect your rights as a taxpayer and citizen, we will be dedicated to that cause. We can deal with the IRS, state taxing authorities, and even local taxing agencies and authorities. Practice areas include:

- Tax controversies, audits

- Individual tax planning

- Mergers, acquisitions, reorganizations, spin-offs, and divestures (divestitures)

- Partnerships, LLCs, & Joint Ventures

- Corporations, including both Subchapter (S) and Subchapter (C)

- Multistate tax planning

- Property tax (including real estate related taxes)

- Sales tax issues

- International tax planning

- Transfer pricing

See Recent Blog Posts Related To Tax Matters

Comparison of Subchapter K v. Subchapter S

July 25, 2022

Both Subchapter K and S of the Internal Revenue Code (IRC) are pass-through tax structures in which the members of the entity are taxed for the entity's …

Read MoreNorth Carolina – A tax friendly place to live and work

July 24, 2017

If you live in North Carolina (or you’re looking to move here), then a bill recently passed into law by the N.C. Legislature might give you some …

Read MoreKelly Brown Earns LL.M. in Tax Law

March 5, 2016

McGrath & Spielberger, PLLC is happy to announce that Attorney Kelly J. Brown has earned her LL.M in Tax Law. Attorney Kelly J. Brown has earned …

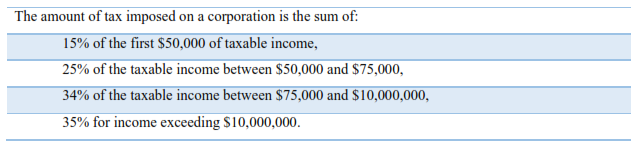

Read MoreTax Rates on Ordinary Income for Businesses

August 19, 2015

When you decide to start a business venture, there are a myriad of things to consider. We regularly assist small business owners, especially start-up businesses, walking them …

Read MoreMortgage Loan Debt Forgiveness

March 24, 2015

Is Canceled Mortgage Loan Debt Income that you are Taxed on?As an attorney with specific tax law knowledge who also works with borrowers to avoid foreclosure and/or …

Read MoreJason McGrath Quoted in Charlotte Observer Story on Mortgage Relief Tax Issues

March 15, 2015

Feb 16, 2015 - The Charlotte Observer | CharlotteObserver.com ..... Jason McGrath, a Charlotte-based attorney who works with clients dealing with mortgage disputes and foreclosures, said that …

Read More