When you decide to start a business venture, there are a myriad of things to consider. We regularly assist small business owners, especially start-up businesses, walking them through the steps that need to be taken in order to make the business official and legal. There are many ways a business can be organized and there are both non-tax and tax factors as well as state and local statutory requirements that need to be taken into consideration when embarking on this exciting journey of starting a business.

I previously wrote an article regarding the non-tax factors that should be considered when starting a business. This article is one of a series of articles that focuses on the tax implications of certain business activities and things you should consider when choosing your business entity. The most prominent federal tax considerations in choosing a business entity include:

- Capital Contributions

- Ownership Restrictions

- Business Income and Loss

- Allocations of Income or Loss

- Basis Limitations and the Deductibility of Losses

- Distributions

- Employment Tax Considerations

- Tax Rates on Ordinary Income

This article discusses the tax rates for businesses and business owners.

Ordinary Income Tax Rates

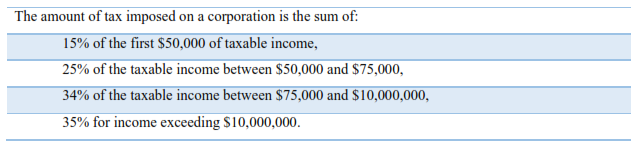

For most C corporations that have significant taxable income, the corporate income tax rate is essentially a flat rate of 34-35%. Corporations with smaller amounts of income enjoy lower rates (15-25%) on their first $75,000 of taxable income. As you can see below, a very small number of small businesses will receive the lower tax rates of 15 and 25%.

Additionally, certain personal service corporations (i.e., lawyers, accountants, architects, and the like) are not entitled to graduated tax rates but receive a flat rate of 35%. Individuals pay tax at the graduated rates of 15%, 28%, 31%, 36%, and 39.6%.

With a presidential election fast approaching and presidential hopefuls throwing their hat in the ring, you can expect some campaign talk of tax reform. On the corporate side, Marco Rubio has talked about tax reform that would lower the tax rate for corporations and passthroughs to 25% (although many of the credits and deductions would be eliminated) and allow businesses to expense the cost of their investments 100% in the year of acquisition. On individual tax reform, Rubio proposes reducing the number of individual tax brackets from 7 to 2 (15% and 35%), eliminate the standard deduction and replace it with a refundable personal credit, and create a $2,500 child tax credit.

The relationships among these tax rates can greatly influence the choice of entity. At one time the maximum individual tax rate on ordinary income peaked at 70% and the top corporate tax rate was 46%, making forming a C corporation an attractive option to avoid the higher individual tax rates. The difference in rates prompted most business owners to organize their entities as a corporation rather than a pass-through entity because corporate income was taxed at much lower rates. During these high individual tax rate times, shareholders that wished to withdraw earnings created tax efficient strategies to avoid the double tax (e.g., owner-employees of a C corporation would distribute profits in the form of salary or fringe benefits, which are tax-deductible by the corporation and the fringe benefits are excludable from income of the employee in most situations). Shareholders also loaned money or leased property to C corporations and withdrew earnings from the corporation in the form of rent or interest payments that were tax deductible as well. The IRS began to crack down on these strategies and attacked payments of salary or interest as unreasonable compensation or disguised dividends. Congress fought back by enacting penalties to patrol against excessive accumulations or avoidance of the individual progressive tax rates. It wasn’t hard for a corporation with good tax planning to justify the payment of reasonable compensation and accumulation of earnings on the basis of reasonable business judgment and thereby avoid constructive dividends and the corporate penalty tax.

Now, individuals and corporations are subject to the same top tax rate and dividends and long-term capital gains are both taxed at relatively low rates, the C corporation earnings accumulation strategy is much less compelling. The parity in the individual and corporate tax rates, in conjunction with the prospect of two levels of tax when a C corporation is sold, provides a greater incentive to use a pass-through entity instead of a C corporation, particularly if the business intends to distribute its earnings currently, does not have owners who work for the firm, or holds assets that are likely to appreciate in value over a relatively short time frame. It would not be beneficial to organize a venture that invests in passive assets such as real estate or financial assets to operate as a C corporation because the costs of doing so would be prohibitive in light of the double tax. In some cases, however, C corporations still offer tax savings, especially for businesses able to pay out most of their earnings as compensation to their high-income owners.

For a complete analysis of the tax implications of C Corporations, Partnerships, and S Corporations click here for the Joint Committee on Taxation’s publication entitled “Choice of Business Entity: Present Law and Data Relating to C Corporations, Partnerships, and S Corporations.”

McGrath and Spielberger, PLLC assists clients with all sorts of tax issues, both federal and state (including but not limited to North Carolina and South Carolina). Click here to contact us about your tax matter.

McGrath & Spielberger, PLLC provides legal services in Florida, Georgia, North Carolina, Ohio, South Carolina, and Tennessee, as well as in some Federal courts. The Firm offers full scale representation, as well as limited scope services, as appropriate for the situation. Please be advised that the content on this website is not legal advice, but rather informational, and no attorney-client relationship is formed without the express agreement of this law firm. Thank you.