This article is one installation in a seven part blog series by McGrath and Spielberger on Legal Opinion Letters. Here are links to the other posts in this series: Part 1, Part 2, … Part 4, Part 5, Part 6, Part 7.

While the specific content of a legal opinion letter varies depending on the context, there are several common components. The letter should explain the purpose of the letter and the specific legal issue being addressed. It will outline the documents and facts the lawyer reviewed, such as corporate records, contracts, or government filings. The legal opinion letter will also summarize other research the attorney performed.

The legal opinion letter may or may not identify the client who hired the lawyer. If that information is included, it might read like this: “Acme Widgets, a North Carolina limited liability company (the ‘LLC’), is the company securing this Certified Legal Opinion Letter.”

The attorney will then state any assumptions they made and any limitations on the scope of their opinion. This is a critical section, as it defines the boundaries of the lawyer’s responsibility. The core of the letter is the legal analysis, where the attorney applies relevant laws and precedents to the facts.

A legal opinion letter should be thorough yet concise, detailed yet reader-friendly, and clear-cut but without attempting to oversimplify the issues.

The legal opinion letter ultimately states the lawyer’s conclusion (the attorney’s professional opinion) and at least a summary as to “why”. The clear structure and legal reasoning explanations contribute to making opinion letters a reliable source of legal information.

Please contact our law firm, McGrath and Spielberger, if you’re interested in a legal opinion letter.

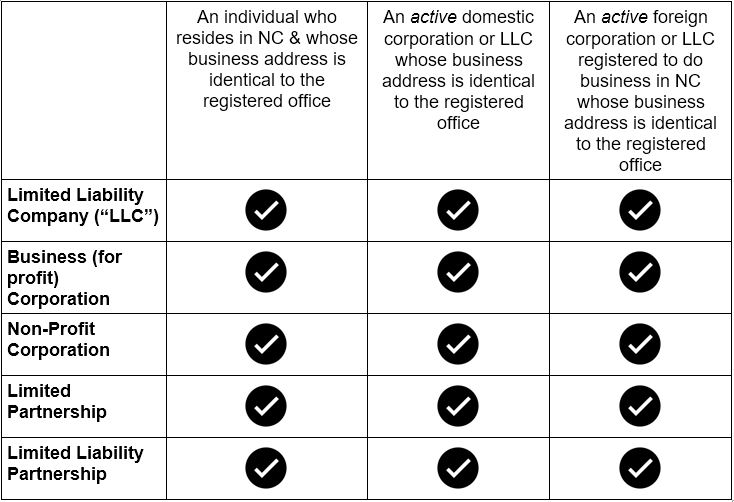

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by