Charlotte-area Foreclosure Filings Decline 16%

By Showcase Realty On October 14, 2014

droberts@charlotteobserver.com

Posted: Thursday, Sep. 12, 2013

Charlotte-area foreclosure filings dropped 16 percent in August from a year ago, as they also fell across the U.S.

The Charlotte region had 982 filings – which comprise default notices, scheduled auctions and bank repossessions – down from 1,166 a year ago. North Carolina filings fell to 2,361, a decline of 12 percent.

Nationwide, foreclosure activity fell largely as a result of fewer properties starting the foreclosure process, according to real estate data firm RealtyTrac. U.S. foreclosure starts dropped to 55,775, their lowest level since December 2005.

For Charlotte, it was the third month in a row of year-over-year declines.Observers point to at least two trends driving down Charlotte foreclosure filings: Rising home prices are increasing equity in homes that are “underwater,” making the owners less likely to allow their properties to fall into foreclosure. Also, they say, some lenders are opting to sell distressed Charlotte-area homes to investors.

“Some of the institutions don’t really want to be in the foreclosure business, so they unload some of their notes that are in default, or nonperforming notes, they call them,” said Nancy Braun, owner of Charlotte-based Showcase Realty.“They sell them to investors at a fraction of the value,” she said. “The investors then can take on the unpleasantries of possibly foreclosing on the party or renegotiating the note with the borrower or doing a short sale with the borrower.”

In Charlotte, investors such as private equity firms have been snapping up bank-owned properties to convert them into rentals. Braun said investor purchases are a factor in Charlotte’s tight inventory situation.

“That’s part of the reason … there’s a shortage of inventory,” she said.

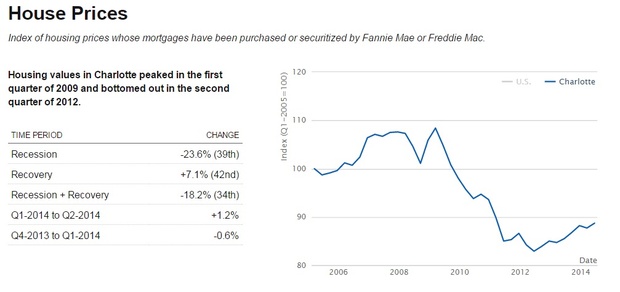

Charlotte’s drop in foreclosures also coincides with home prices increasing here and elsewhere. On Tuesday, the Charlotte Regional Realtor Association reported the average home price in the region rose to $237,635 in August, the largest year-over-year gain so far in 2013. That’s up 11 percent from $213,846 in August 2012.

Home prices are rising across the U.S. as mortgage rates increase and supplies of homes for sale remain tight in many areas. RealtyTrac says the increase in prices is good news for homeowners who are underwater – those who owe more on their homes than they are worth. Those owners have more equity as prices overall rise.

Foreclosure filings in Charlotte remain below their peak of 2,141 in August 2009.

Even though overall filings fell in the Charlotte region, bank repossessions and default notices increased year over year in August, RealtyTrac said. Repossessions climbed 33 percent to 330 properties, compared with 249 properties a year ago. Default notices increased 1,620 percent, to 172 from 10 a year ago.

‘Desperate homeowners’

While overall foreclosure filings are down, Charlotte homeowners who have already fallen into foreclosure are still battling their lenders.

Jason McGrath, a Charlotte-based lawyer who defends struggling homeowners, said his office, in roughly the past few months, has seen an increase in demand from clients facing foreclosure hearings that are only a week or two away or whose homes are already scheduled for foreclosure sales.

“There are clearly many desperate homeowners out there that are still facing foreclosure and are still struggling to make every effort they can to avoid it,” he said.

Despite the falling number of foreclosure filings, some predict a surge in foreclosures in coming months.

Daren Blomquist, vice president for RealtyTrac, said foreclosures are expected to rise in some U.S. markets as lenders move forward with foreclosure starts that had been delayed.

McGrath expects an increase in Charlotte, too.

“There’s some theory out there that we’re going to see a ramp up in foreclosure filings in 2014,” he said.

Source: http://www.charlotteobserver.com/2013/09/12/4306203/charlotte-area-foreclosure-filings.html

᠃