This is one of a series of articles by our law firm on the topic of registered agents. For more articles on this topic, click here to access the “Registered Agent” category of articles, or select a title below.

-

Registered Agent for your North Carolina Business – What your Mandatory Registered Agent Does

-

Registered Agent for your North Carolina Business – Who Can be the Registered Agent

More articles coming soon!

First, whose Registered Agent are we referring to? We’re talking about a corporation or a limited liability company, so we mean the business entity you might own or manage, and the legal requirement in North Carolina that it have a Registered Agent (all sometimes called an “RA”).

Second, what “you” are we referring to when we ask about eligibility to be the RA? The answer to this question makes a big difference.

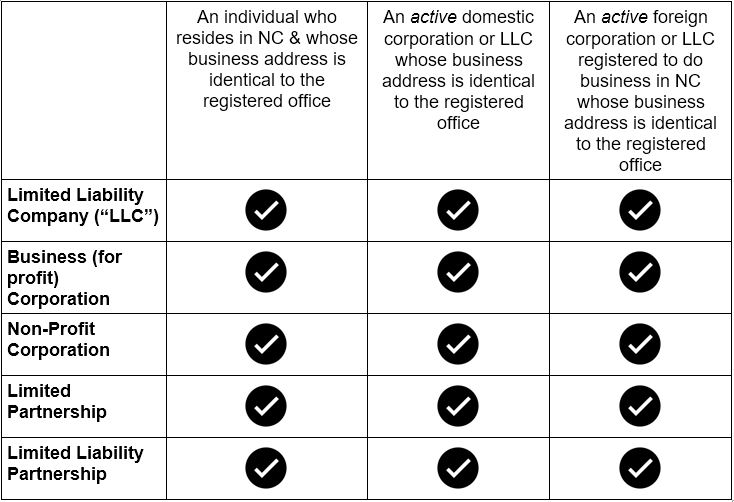

Can an owner, shareholder, member, or officer of a corporation or limited liability company be the RA for that business entity? Yes, as long as they reside in NC and their business address is identical to the registered agent office listed.

Can a staff member or “regular employee” of a corporation or limited liability company be the RA for that business entity? Yes, as long as they reside in NC and their business address is identical to the registered agent office listed.

Can someone not affiliated with the corporation or limited liability company in any other way be the RA for the business entity? Yes, as long as they reside in NC and their business address is identical to the registered agent office listed.

Can a corporation or business entity serve as the RA for itself? Apparently not. Interestingly, North Carolina’s statutes do not appear to directly rule this out. However, we have witnessed instances in which the NC Secretary of State has rejected attempts by business entities to do this. You can argue both sides of the question, but unless the North Carolina Secretary of State’s office changes its position (voluntarily or due to a court ruling), if you want a corp. or LLC to be your Registered Agent, it will need to be a properly qualified different corp. or LLC as your Registered Agent.

The bottom line: it’s vitally important to have a Registered Agent who is compliant and reliable.

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by clicking here or calling us at 800.481.2180.)

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by