Attorney Jason McGrath explains some things to consider when deciding whether to follow a contract’s arbitration clause or file a lawsuit in this short video.

Click here to watch on YouTube or watch the video below.

Here are some of the key points contained in the video:

- How do you end up in arbitration vs. in court?

- Typically, someone has to decide – do we follow the arbitration clause or just file a lawsuit?

- Parties usually just file a formal lawsuit as if there is no arbitration clause.

- There can be some negatives to ignoring the arbitration clause.

You should have your attorney take a look at the contract and then make a careful decision on how to proceed based on a through legal analysis of your case and the contract.

If you need legal services in North Carolina, South Carolina, Georgia, Florida, Ohio, or Tennessee we invite you to fill out our confidential client form for possible legal assistance.

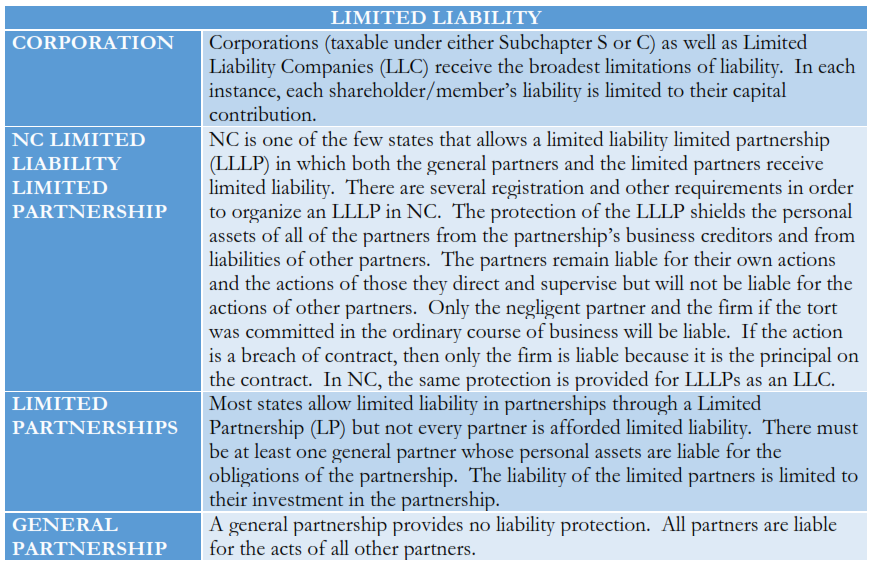

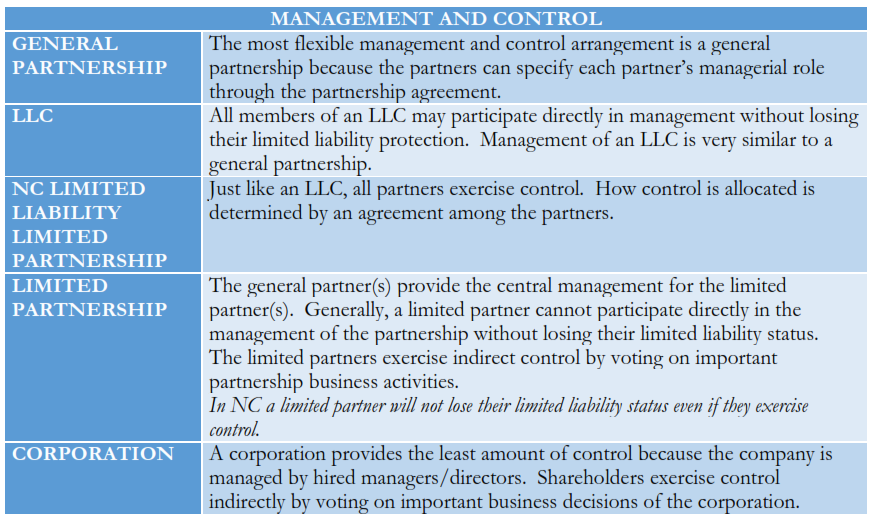

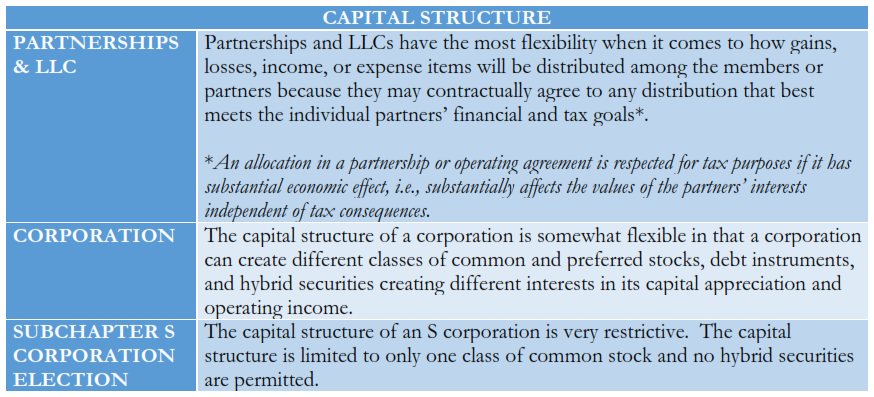

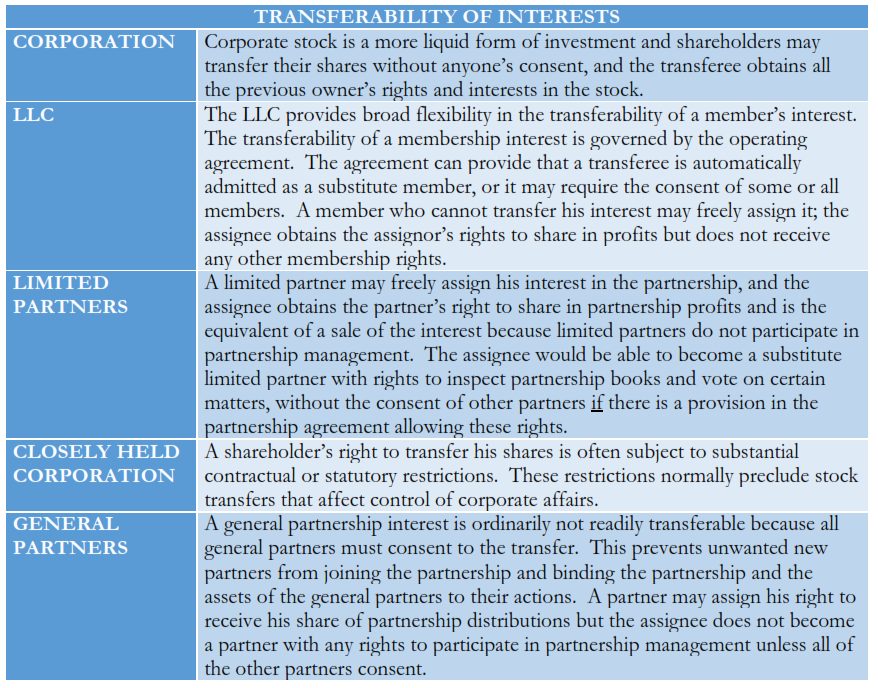

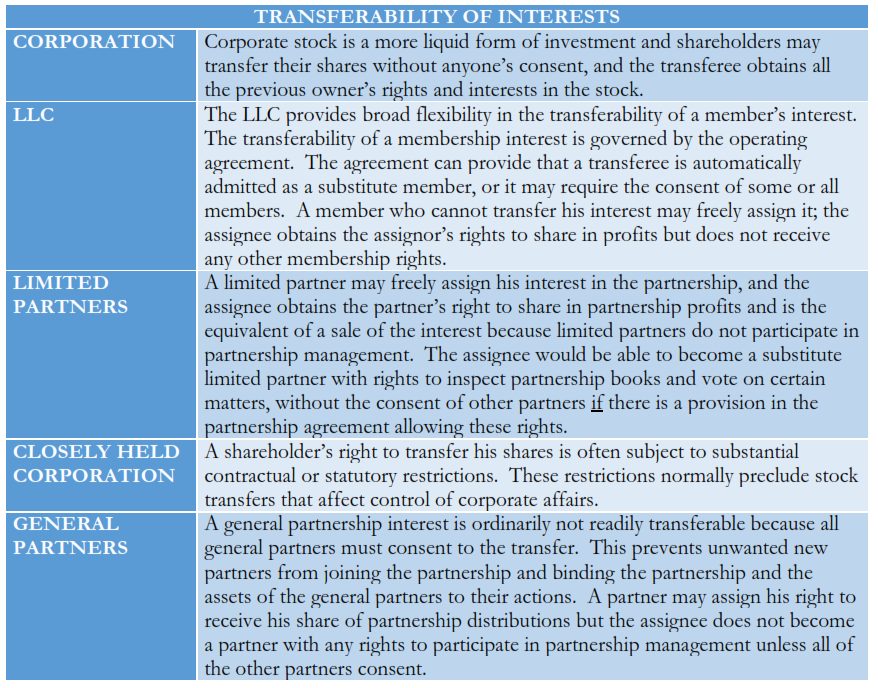

When you decide to start a business venture, there are a myriad of things to consider. You have possibly already chosen the purpose of your venture and what it is you are going to make, do, or sell. You have probably also played around with what to name your business. Now what? Where do you go from here?

When you decide to start a business venture, there are a myriad of things to consider. You have possibly already chosen the purpose of your venture and what it is you are going to make, do, or sell. You have probably also played around with what to name your business. Now what? Where do you go from here?