Blog

Legal Opinion Letters Part 7: What They Are – But Also What They Are Not

This article is the final installation in a seven blog series by McGrath and Spielberger on Legal Opinion Letters. Here are links to the other posts in this series: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6.

While a legal opinion letter is a powerful tool, it’s essential to understand what they are vs. what they are not. It’s important to know what they can do versus what they don’t do.

First and foremost, a legal opinion letter is not a guarantee of a particular outcome. The law can be subject to different interpretations, and the facts of a situation can change. The letter is only as good as the information provided to the lawyer and/or discovered by the lawyer. Even acting in good faith, the client may fail to provide all relevant information or the attorney may not identify a key piece of legal information to consider.

Like everything else in this world, imperfections can and do occur. Although our law firm has, thankfully, not had this happen, mistakes related to legal opinion letters exist and can weaken or even invalidate the opinions expressed.

Furthermore, the legal opinion letter is typically limited in scope to a specific issue and a particular point in time. It doesn’t provide a general assessment of all legal risks. The letter also often contains specific qualifications and assumptions which must be carefully reviewed by the recipient. For example, an opinion on the enforceability of a contract might be qualified by the assumption that the parties have the legal capacity to enter into the agreement. By understanding these limitations, parties can use legal opinion letters effectively without overestimating their scope or certainty.

Please contact our law firm, McGrath and Spielberger, if you’re interested in a legal opinion letter.

Legal Opinion Letters Part 6: When To Seek A Legal Opinion Letter

This article is the sixth of a seven part blog series by McGrath and Spielberger on Legal Opinion Letters. Here are links to the other posts in this series: Part 1, Part 2, Part 3, Part 4, Part 5.. Part 7.

Knowing when to request a legal opinion letter is just as important as understanding what it does. The following are some situations in which it makes sense to retain an attorney to prepare a legal opinion letter for your business, whether that letter is going to remain internal to your LLC or corporation or will also be presented to third parties.

- Any important situation or issue your company is legally uncertain about.

- Entering into a significant contract.

- Determination of whether a certain action would breach a contract.

- Launching operations in a new jurisdiction.

- Facing legal compliance challenges or questions.

- Questions about whether an action would be compliant with internal governing rules (such as by-laws, an operating agreement, a shareholders’ agreement, etc.).

- Wanting to ensure clean and clear title for real estate.

- Determination if a certain action would be illegal.

- Enforceability of a contract or a security instrument.

- Evaluation of liability exposure.

- Analysis of legal outcomes for other businesses which have engaged in similar activities or been involved in similar legal situations.

- A business partner or potential partner requires it.

There are many more situations which could lead to a legal opinion letter.

Please contact the law firm of McGrath and Spielberger if you’re interested in a legal opinion letter.

Legal Opinion Letters Part 5: Legal Advice Vs. Opinion Letter

Legal Opinion Letters Vs. Legal Advice: What’s The Difference?

This article is one installation in a seven part blog series by McGrath and Spielberger on Legal Opinion Letters. Here are links to the other posts in this series: Part 1, Part 2, Part 3, Part 4, … Part 6, Part 7.

Although they sound similar, legal opinion letters differ from personalized legal advice. While advice is typically confidential and tailored to a client’s unique situation, opinion letters are often meant to be shared with third parties.

Primary Purpose.

- Legal Opinion Letter: reassurance and confirmation

- Legal Advice: guidance and recommendations

Intended Recipient / Audience.

- Legal Opinion Letter: usually other persons / businesses in addition to the client

- Legal Advice: usually just the client

Confidentiality.

- Legal Advice: typically intended to be confidential and only between the lawyer and the client.

- Legal Opinion Letter: usually intended to also be shared with persons / businesses other than the lawyer and the client.

Understanding this distinction can help businesses decide when an opinion letter is the appropriate tool or whether its legal advice which is more applicable.

Please reach out our law firm, McGrath and Spielberger, if you’re interested in a legal opinion letter.

Legal Opinion Letters Part 4: The Role Of The Attorney

This article is part of a seven blog series by McGrath and Spielberger on Legal Opinion Letters. Here are links to the other posts in this series: Part 1, Part 2, Part 3, … Part 5, Part 6, Part 7.

Writing a legal opinion letter is a significant professional responsibility for an attorney. The lawyer must exercise a high degree of care and diligence to ensure their opinion is accurate and well-reasoned. This often involves extensive research, reviewing complex documents, and sometimes, seeking clarification from other parties.

Writing a legal opinion letter is a significant professional responsibility for an attorney. The lawyer must exercise a high degree of care and diligence to ensure their opinion is accurate and well-reasoned. This often involves extensive research, reviewing complex documents, and sometimes, seeking clarification from other parties.

The lawyer has a duty to provide an honest and objective assessment. This includes identifying situations for which the answer is not entirely clear. Sometimes, the attorney is attempting to “prove a negative”, which can be very challenging. For example, a business client may have asked for a legal opinion letter to address the issue of “Proof that this business activity is not outlawed by North Carolina law.”

The attorney must be careful to avoid expressing opinions on matters which are beyond their professional competence or that are not supported by a thorough factual and legal investigation.

Ultimately, the attorney has to do the best they can to come to and express conclusions in which they are confident – and that others can rely on.

Please contact our law firm, McGrath and Spielberger, if you’re interested in a legal opinion letter.

Legal Opinion Letters Part 3: Key Components Of A Legal Opinion Letter

This article is one installation in a seven part blog series by McGrath and Spielberger on Legal Opinion Letters. Here are links to the other posts in this series: Part 1, Part 2, … Part 4, Part 5, Part 6, Part 7.

While the specific content of a legal opinion letter varies depending on the context, there are several common components. The letter should explain the purpose of the letter and the specific legal issue being addressed. It will outline the documents and facts the lawyer reviewed, such as corporate records, contracts, or government filings. The legal opinion letter will also summarize other research the attorney performed.

The legal opinion letter may or may not identify the client who hired the lawyer. If that information is included, it might read like this: “Acme Widgets, a North Carolina limited liability company (the ‘LLC’), is the company securing this Certified Legal Opinion Letter.”

The attorney will then state any assumptions they made and any limitations on the scope of their opinion. This is a critical section, as it defines the boundaries of the lawyer’s responsibility. The core of the letter is the legal analysis, where the attorney applies relevant laws and precedents to the facts.

A legal opinion letter should be thorough yet concise, detailed yet reader-friendly, and clear-cut but without attempting to oversimplify the issues.

The legal opinion letter ultimately states the lawyer’s conclusion (the attorney’s professional opinion) and at least a summary as to “why”. The clear structure and legal reasoning explanations contribute to making opinion letters a reliable source of legal information.

Please contact our law firm, McGrath and Spielberger, if you’re interested in a legal opinion letter.

Legal Opinion Letters Part 2: The Value Of A Legal Opinion Letter

Why are legal opinion letters so valuable? In a business context, they serve as a form of risk management. For example, a lender might require a legal opinion letter from the borrower’s counsel to confirm that the borrower is a legally existing entity and that the loan agreement is enforceable. This provides the lender with confidence that their investment is secure.

Similarly, in a real estate transaction, a North Carolina limited liability company which is a would-be buyer might ask for a legal opinion on the title to ensure there are no outstanding liens or other claims. Beyond transactions, these letters can be useful in litigation to assess the strengths and weaknesses of a case, or to a corporation to ensure compliance with a particular regulation.

There are other situations in which a South Carolina corporation, for example, wants internal confirmation that a certain activity is legally allowable, and thus obtains a legal opinion letter on the topic at hand. Another example would be a Tennessee LLC seeking to provide its business partners with a legal opinion letter in order to facilitate mutual business activities and opportunities.

By providing a clear, unbiased assessment of a legal situation, a legal opinion letter can help parties make informed decisions, avoid costly disputes, and ultimately, close deals with greater certainty.

Please contact our law firm, McGrath and Spielberger, if you’re interested in a legal opinion letter.

This is part two of a blog article series by McGrath and Spielberger on Legal Opinion Letters. Click here to go to “Part 1: What Is A Legal Opinion Letter?“. Next week, we will share “Part 3: Key Components Of A Legal Opinion Letter”.

Legal Opinion Letters Part 1: What Is A Legal Opinion Letter?

A legal opinion letter is a formal document drafted by a lawyer which expresses their professional judgment on a specific legal matter. It’s not a guarantee of a particular outcome, but rather a reasoned analysis based on the facts provided and the attorney’s understanding of the law. These letters are often requested related to corporate business transactions and real estate transactions.

The purpose is to provide assurance to one or more parties that a specific legal requirement has been met or that a certain legal risk is manageable. The legal opinion letter typically includes a detailed summary of the facts, the legal issue being addressed, the applicable laws, and the lawyer’s conclusion.

The legal opinion letter may address the law of a specific jurisdiction. An example might be a South Carolina LLC which hopes to extend a certain business activity across the border to North Carolina. The company would then ask for a legal opinion letter which analyzes the legality (or legal limitations or conditions) of that same activity in North Carolina.

Legal opinion letters are a crucial tool for due diligence, helping to identify and mitigate potential legal pitfalls before a deal is finalized.

Please contact our law firm, McGrath and Spielberger, if you’re interested in a legal opinion letter.

This is part one of a blog article series by McGrath and Spielberger on Legal Opinion Letters. As the series continues, we will add the links to each new article here to make them easy to find. Next week, we will share Part 2 “The Value Of A Legal Opinion Letter”.

Business Ownership Deals (Part 6 of Series): How Many Different Attorneys Need To Be Involved?

The “owners” of a Limited Liability Company are traditionally referred to by attorneys as the LLC’s “Members”. It’s important to realize that (with some variation from state to state) there can be “Members” but also what may be referred to as “Economic Interest Owners”, and those are not the same thing. However, for the rest of this article and related articles, we’re just going to use the terms “Member” and “Owner” as synonyms, and Owner is going to mean someone who has full rights in the Company (mainly meaning having voting and economic rights).

The “owners” of a Limited Liability Company are traditionally referred to by attorneys as the LLC’s “Members”. It’s important to realize that (with some variation from state to state) there can be “Members” but also what may be referred to as “Economic Interest Owners”, and those are not the same thing. However, for the rest of this article and related articles, we’re just going to use the terms “Member” and “Owner” as synonyms, and Owner is going to mean someone who has full rights in the Company (mainly meaning having voting and economic rights).

A very common question we get asked at our law firm of McGrath and Spielberger is “What do I need to do to add an owner to my company?” The answer to that exact question is similar to the related question of “How do we transfer the ownership interests of a Member who is leaving the LLC?”

The process and legal mechanics of changes to business ownership are largely discussed in the first 5 parts of this series. In this article, we’ll focus on questions such as the following.

- Can (or should) an attorney represent both a buyer and a seller?

- Can an attorney serve in a neutral role, essentially working on the transaction without representing a particular party?

- Does each party involved in the deal need their own lawyer / law firm?

- Can the same attorney / law firm represent the LLC and also give advice to individual members?

As is the case in most things “legal”, the devil is in the details, “it depends”, and “changing one fact about the situation may change the answers”. Having said that, here’s how it generally works, based largely on the professional regulations which apply to lawyers (which differ somewhat from state to state and which are typically called the “Rules of Professional Conduct”).

- Can (or should) an attorney represent both a buyer and a seller? NO. A single lawyer / law firm should not, and usually could not, represent the buyer and the seller.

- Can an attorney serve in a neutral role, essentially working on the transaction without representing a particular party? YES. In fact, this is an underutilized scenario. Realistically, this can be a bit tricky or even awkward, but in many instances this works just fine and can save everyone significant time and money.

- Does each party involved in the deal need their own lawyer / law firm? NO in the sense that nobody “has” to have an attorney at all (unless perhaps the Operating Agreement says otherwise). NO in the sense that a single attorney can usually represent parties who are aligned / have common interests. YES in the sense that an attorney should not, and typically could not, represent parties who have opposing interests (even if there is no “dispute”).

- Can the same attorney / law firm represent the LLC and also give advice to individual members? YES, NO, MAYBE? The answer to this one is similar to (C) above. Many non-lawyers (and even some lawyers) may not always clearly grasp that “representing someone” and “giving advice” are essentially the same thing. For example, this is not terribly uncommon:

- LLC Member: “Hey Lawyer, I realize you don’t represent me, but can you just tell me if anything in this proposed Membership Interest Transfer Agreement is unfair to me?”

- Lawyer: “I’m sorry, I can’t give you that advice (which would more or less make you my client, or at least blur that line), since I represent a different party in this situation, whose interests may not completely align with yours.”

On the other hand, a lawyer typically would be allowed to represent (for example) the LLC itself and aligned owners, in particular owners who are not buying or selling. There are other combinations of parties who could be represented by the same lawyer in the same transaction / situation.

Another important aspect of this (not further explored here) is a “waiver of conflicts of interest”. In a high level sense, parties – to a certain extent – can waive some conflicts of interest or potential conflicts of interest. Doing so may allow a single attorney / single law firm to represent multiple parties when that perhaps could not happen without the conflict of interest waiver by those parties.

These sorts of LLC transaction issues are commonly dealt with by business law attorneys but can be tricky. Paying attention to these details, being careful, and planning ahead gets the best results for clients, which is what we do here at McGrath & Spielberger.

If you’d like assistance with business compliance services, please click here: https://mcgrathspielberger.com/business-compliance-services/.

Business Ownership Deals: Buying And Selling (Transferring) Membership Interests In LLCs – Part 5, Filings With The Secretary Of State

A very common question we get asked at our law firm of McGrath and Spielberger is “What do I need to do to add an owner to my company?” The answer to that exact question is similar to the related question of “How do we transfer the ownership interests of a Member who is leaving the LLC?” Of course, you can also have a situation in which a current Member is only transferring or selling some of that Member’s interests in the company.

This Part 5 of our ongoing series focuses on the filings that can or should be made with the Secretary of State as a result of a change in ownership / membership. See Part 1 of this series for a general overview of sale / purchase / transfer of company membership interests and the legal process, Part 2 for more information on the Purchase and Sale Agreement / Membership Interest Transfer Agreement, Part 3 regarding “Resolution” which should be a part of the membership interest (ownership) transfer process, and Part 4 for important information about Operating Agreement issues.

A transfer of membership / ownership interests in an LLC can, and sometimes should, result in new filings with the Secretary of State. The most common change, but not necessarily the only one, would be made by filing an Amendment to Articles of Organization. That Amendment could identify the changes in ownership structure. Similar information would be contained in the next-filed Annual Report, at least in states like North Carolina which require your typical limited liability company to file such reports.

Whether such an Amendment to Articles of Organization should be filed – and what exactly it should say – will depend on each specific circumstance. An Amendment document on file with the Secretary of State would be evidence of what information the Amendment contains.

An example of another appropriate filing with the Secretary of State would be for the LLC’s Registered Agent. (Click here for an explanation of Registered Agents.) If the Registered Agent has been an outgoing LLC Member, it would almost certainly be preferable to change the identity of the Registered Agent. That change is made by filing documentation with the Secretary of State, and of course the new Registered Agent (which could be our law firm, if the company is located in the Carolinas) has to have given permission.

These sorts of LLC filings are commonly worked on by business law attorneys. However, attorneys need to pay attention and have their brains and skill sets engaged even when performing straightforward work. Paying attention gets the best results for clients, which is what we do here at McGrath & Spielberger.

If you’d like assistance with business compliance services, please click here: https://mcgrathspielberger.com/business-compliance-services/.

Business Ownership Deals: Buying And Selling (Transferring) Membership Interests In LLCs – Part 4, Operating Agreement (“OA”) Changes

A very common question we get asked at our law firm of McGrath and Spielberger is “What do I need to do to add an owner to my company?” The answer to that exact question is similar to the related question of “How do we transfer the ownership interests of a Member who is leaving the LLC?” Of course, you can also have a situation in which a current Member is only transferring or selling some of that Member’s interests in the company.

This Part 4 of our ongoing series focuses on Operating Agreement amendments and/or similar changes as a result of a change in ownership / membership. See Part 1 of this series for a general overview of sale / purchase / transfer of company membership interests and the legal process, Part 2 for more information on the Purchase and Sale Agreement / Membership Interest Transfer Agreement, and Part 3 regarding “Resolution” which should be a part of the membership interest (ownership) transfer process.

A transfer of membership / ownership interests in an LLC should result in amending the Operating Agreement (shorthand = “OR”) or the creation and execution of a new Operating Agreement. We’ll now address 3 different common scenarios, and keep in mind these are brief summaries, they are not intended to be a detailed or comprehensive listing of all relevant or necessary items / issues.

- AMENDING THE WRITTEN OPERATING AGREEMENT. If there is a written, executed OA in place of reasonable quality, then an amendment document can be utilized. The Amendment to OA would at least summarize the situation and the changes, reference other key documents, be dated, and be executed by the LLC itself and each individual Member (including any new Members and any outgoing Members).

- REPLACING AN EXISTING OPERATING AGREEMENT. There are times when replacing a past-written OA with a new one makes the most sense, including when there is a change in ownership. We’ll address this in more detail in a separate article.

- CREATING THE COMPANY’S FIRST WRITTEN OPERATING AGREEMENT. Many LLCs do not have a written OA. In nearly every instance, the creation and execution of a written OA should take place in light of the change in ownership structure. Interestingly, depending on the circumstances and applicable strategical goals, sometimes it makes sense for that OA to come into existence: before the change in membership (which may then also require an Amendment to OA as discussed above); or concurrent with the change in membership; or after the change in membership. We may address those timing options, and why each could make sense, in a different article.

An Amendment to Operating Agreement is often 1 or 2 pages long. An entire Operating Agreement is typically between 10 and 50 pages long. Yes, you correctly infer that there is a wide variety as to how complex and detailed Operating Agreements can be.

An LLC Operating Agreement is typically a private document vs. something which gets “filed” with anyone. This doesn’t mean it is forever confidential, it’s just internal. The contents of an LLC OA could be agreed to be confidential by the parties, although that also does not guarantee it will never be seen by outside persons or entities.

The law does not require an LLC OA to be notarized or witnessed by any third parties. In concept, there could be a requirement within a certain limited liability company which does require it – but that would be uncommon.

The LLC OA – including any properly agreed upon amendments – are typically part of the formal proof of the issues covered in the OA. This means that membership / ownership listings (including changes) in such documents are excellent proof of who owns how much. Anyone who is a signor to an OA or related Amendment should have a tough time later claiming to be unaware of the content of such documents or to deny that they agreed to the content.

LLC Operating Agreements and their Amendments are commonly worked on by business law attorneys. However, attorneys need to pay attention and have their brains and skill sets engaged even when performing straightforward work. Paying attention gets the best results for clients, which is what we do here at McGrath & Spielberger.

Business Ownership Deals: Buying And Selling (Transferring) Membership Interests In LLCs – Part 3, The Company Resolution

A very common question we get asked at our law firm of McGrath and Spielberger is “What do I need to do to add an owner to my company?” The answer to that exact question is similar to the related question of “How do we transfer the ownership interests of a Member who is leaving the LLC?” Of course, you can also have a situation in which a current Member is only transferring or selling some of that Member’s interests in the company.

See Part 1 of this series for a general overview of sale / purchase / transfer of company membership interests and the legal process and Part 2 for more information on the Purchase and Sale Agreement / Membership Interest Transfer Agreement. This Part 3 focuses on the “Resolution” which should be a part of the membership interest (ownership) transfer process.

Key decisions by and for a limited liability company should be – and sometimes must be – voted upon, with the vote outcome and resulting decision permanently recorded in writing. When such votes and decisions result in a fundamentally important action being taken, it is proper to have an “LLC Resolution” document created and executed. (Technically, a decision not to take action can also be memorialized in an LLC Resolution.)

An LLC Resolution document can be made up of the elements in the bullet point list below, which is a basic list and example; of course, each situation is different. A transfer of membership / ownership interests in an LLC should result in an LLC Resolution as part of that legal process. Some basic elements of LLC Resolutions:

- header / title

- the formal name of the LLC

- names of the parties to the Resolution

- background / context

- a description of the circumstances which led to the decision

- what, exactly, have the parties to the Resolution now resolved to do?

- date of the Resolution

- names and signature lines for the parties to the Resolution

An LLC Resolution is typically a private document vs. something which gets “filed” with anyone. This doesn’t mean it is forever confidential, it’s just internal. The contents of an LLC Resolution could be agreed to be confidential by the parties, although that also does not guarantee it will never be seen by outside persons or entities.

The law does not require an LLC Resolution to be notarized or witnessed by any third parties. In concept, there could be a requirement within a certain limited liability company which does require it – but that would be uncommon.

The LLC Resolution is typically part of the formal proof that a company and its members followed the rules to decide whether to act on a major issue and then in fact do so. It also serves to be a clear-cut, summary type statement of what was agreed upon and is being done. Anyone who is a signor to that Resolution should have a tough time later claiming to be unaware of what was decided or to deny that they agreed to the decision.

Most experienced business law attorneys can handle an LLC Resolution without too much trouble – and that would typically be part of a larger set of work the attorney is handling for the company. However, attorneys need to pay attention and have their brains and skill sets engaged even when performing straightforward work. Paying attention gets the best results for clients, which is what we do here at McGrath & Spielberger.

Business Ownership Deals: Buying And Selling (Transferring) Membership Interests In LLCs (Part 2)

The Purchase / Sale / Transfer Agreement Itself

A very common question we get asked at our law firm of McGrath and Spielberger is “What do I need to do to add an owner to my company?” The answer to that exact question is similar to the related question of “How do we transfer the ownership interests of a Member who is leaving the LLC?” Of course, you can also have a situation in which a current Member is only transferring or selling some of that Member’s interests in the company.

See Part 1 of this series for a general overview of sale / purchase / transfer of company membership interests and the legal process. This Part 2 focuses on the contract between the parties involved in the transaction, typically the Seller (Transferor) and the Buyer (Transferee), with the limited liability company itself often being a party to the agreement as well.

The agreement between the parties involved in the transaction is often called the “Membership Interest Transfer Agreement” or “Membership Interest Purchase and Sale Agreement” and states the terms of the agreement between the parties transferring ownership interests amongst each other. It’s important to note that the LLC itself may also want to be or need to be a party to such agreements.

Is this business contract a private document or does it become a public record? Typically, a Membership Interest Purchase and Sale Agreement is a private document and does not get “filed” or “recorded” anywhere. That doesn’t mean it can’t be ordered produced by a court, and of course there are other situations in which it must be or should be produced to certain government agencies or other private third parties.

What are the goals and purposes of a Membership Interest Transfer Agreement? There are many, and to some extent they will vary from situation to situation. The most common, most fundamental goal and purpose is to set forth in specific, clear detail what the

Here are some key issues which should definitely be covered in a Membership Interest Purchase and Sale Agreement, and of course this is not a complete list.

- The full names of the parties; the full name of the LLC should be listed even if the LLC is not a party.

- The date the transaction is effective.

- The ownership structure before the transaction and what it will be after the transaction.

- What items of value are being exchanged between the transacting parties (most often, Member A is selling ____% of the company’s membership interests in exchange for $_____).

- What responsibilities / liabilities each of the parties has and doesn’t have as a result of the transaction, and the timing of the same.

○ For example, if Member A is selling all Member A’s interests, does Member A retain any responsibility or liability after the date of the transaction?

○ What happens if the new Member is subjected to negative consequences related to a new legal claim for events which occurred before becoming a Member, especially if Member A helped cause the claim?) - That the transaction has been approved, to the extent necessary, by other Members and/or the limited liability company itself.

- Signatures of the parties (and sometimes of relevant other persons or entities).

We also point out that there are arguments to be made that the selling / transferring Member’s spouse (if there is one) should join in the Membership Interest Purchase and Sale Agreement.

Finally, we observe that if it’s a purchase / sale situation and the selling Member is not receiving all the purchase price up front, there are additional important items to add to the Membership Interest and Purchase Agreement and the use of a well-qualified attorney becomes even more important.

Look for more parts of this series to come!

Business Ownership Deals: Buying And Selling (Transferring) Membership Interests In LLCs (Part 1)

The “owners” of a Limited Liability Company are traditionally referred to by attorneys as the LLC’s “Members”. It’s important to realize that (with some variation from state to state) there can be “Members” but also what may be referred to as “Economic Interest Owners”, and those are not the same thing. However, for the rest of this article and related articles, we’re just going to use the terms “Member” and “Owner” as synonyms, and Owner is going to mean someone who has full rights in the Company (mainly meaning having voting and economic rights).

A very common question we get asked at our law firm of McGrath and Spielberger is “What do I need to do to add an owner to my company?” The answer to that exact question is similar to the related question of “How do we transfer the ownership interests of a Member who is leaving the LLC?”

We’ll discuss which of these documents are public records filed with the Secretary of State vs. private records in a different article.

Whether you’re selling part of your LLC in North Carolina, buying into a limited liability company in South Carolina, or transferring membership to a family member in Tennessee, the steps are going to be similar. Of course, this article is not specific legal advice and you need to consult an attorney about the specifics of your situation.

- The agreement between the parties involved in the transaction. This might be called the “Membership Interest Transfer Agreement” or “Membership Interest Sale and Purchase Agreement” and states the terms of the agreement between the parties transferring ownership interests amongst each other. It’s important to note that the LLC itself may also want to be or need to be a party to such agreements.

- The LLC resolution. For key issues and situations, limited liability companies should generally hold votes or otherwise make decisions according to the law and the Operating Agreement and memorialize (record in writing) the issue and the outcome. In other words, what was decided / approved, if anything? An LLC decision to approve the transfer of ownership interests should be memorialized in a document called a “Resolution”.

- Operating Agreement: amendment or new agreement entirely? The changes in the LLC’s ownership structure should result in the Operating Agreement being formally amended. Sometimes the company doesn’t have a written Operating Agreement, meaning one needs to be created. In certain other instances, a change in membership structure for the limited liability company could or should result in a brand new Operating Agreement even when there was a written one in existence.

- Filings with Secretary of State. Some changes in company ownership will require new, updated, or different documents to be filed with the Secretary of State. Other instances should trigger such documents.

- IRS filings. We aren’t going to attempt to get into the many twists and turns of when changes in an LLC’s ownership may require X, Y, and/or Z changes with the IRS – just be aware that could need to occur.

- Beneficial Ownership Information Report filings / compliance with the Corporate Transparency Act. This article is not going to delve into this issue in any detail, although others will. Just be aware that changes to LLC ownership could require (updated) Beneficial Ownership Information Report filings.

This is not necessarily an all inclusive list; the more complex the ownership structure is and/or the more complex the changes are, the more likely there would be additional formal steps to take.

Also keep in mind the many business-oriented and practical changes and updates which can be required because of a change in ownership structure.

Other interesting questions related to business owner deals are “Can (or should) just 1 attorney do all this work? Does each party involved in the deal need their own lawyer? Can the attorney represent the LLC and also give advice to individual members?” We’ll address those sorts of issues in a different article.

Most experienced business law attorneys can handle this sort of work. It’s not always that complicated from an attorney perspective, but it takes time and dedicated effort, and the attorney needs to keep the brain engaged instead of lapsing into cruise control. Paying close attention helps the client get the best results.

Do You Want Your Lawyer To Be A Jerk?

TV and movies are full of lawyers who are … choose your own adjective, for purposes of this article we are going to use “jerks”. Real life, of course, contains some lawyers who are jerks, but they are truly a small minority of the profession.

The question remains – do you want your lawyer, your attorney, to be a jerk? Not a jerk toward you, of course, but toward the opposition or other party, whether in a real estate litigation case or a business law contractual negotiation?

Some people want that, or think they want that. Some lawyers – perhaps especially those who grew up more recently, when TV characters became more nasty – think that being a jerk is part of being a lawyer, and that’s what they should be.

There is a huge difference between an attorney being assertive and a strong advocate for a client versus being a jerk. Being “tough” is too often confused with being a jerk. Your lawyer being a jerk toward the opposition is unlikely to help you, while on the other hand it: (A) may harm your case; and (B) will certainly make your legal situation more expen$ive. We’ll explain why.

*****

How Your Attorney Being A Jerk Might Harm Your Lawsuit.

What do most people – perhaps especially these days – do when they feel attacked? They get angry and either counterattack or get defensive.

A lawyer who is being a jerk to a witness is almost certainly going to cause that witness to be hostile, or more hostile. That hostility will be directed at the attacking lawyer and the attacking lawyer’s client(s). Having testimony that is even more “against” your own client is typically harmful.

You might be thinking “Yes, but attacking might lead to the witness making a mistake or being caught in a lie!” Sure, that can happen. But a more effective technique, which also doesn’t have the downside risk, is for a lawyer to use a calm and precise approach which leads the witness where the lawyer wants the testimony and evidence to go.

Another aspect of this which most clients would not have a reason to be aware of is the perception of others (especially a judge and/or jury) and how they react to your lawyer’s behavior. A lawyer who behaves like a jerk is ultimately not going to be liked by a judge or most of a jury, is not going to get the benefit of the doubt from those very important persons, and will not be as credible.

How Your Attorney Being A Jerk Might Harm Your Contract Negotiation.

There are other negative ways in which a lawyer’s rude behavior can harm a client. Contract negotiations, by their nature, include the lawyer huddling with the client and then going back and forth with the other side. Communicating the client’s position calmly and professionally increases the chances that the other side won’t just knee-jerk react negatively.

If I, as your lawyer, send proposed changes in a reasonable and professional manner, I am putting you in a better position to succeed. If I’m a jerk about it, or even if the proposed contractual changes are written in an unnecessarily off-putting manner, I’m harming your chances of getting what you want.

How Your Attorney Being A Jerk Makes Your Legal Matter More Expen$ive.

First, some background information: for most common legal deadlines during a lawsuit, the parties / their attorneys can mutually agree to one or more extensions without having to get court approval and without having to have a court hearing.

This scenario is very common in the world of litigation:

- Defendant has a legal deadline coming up;

- Defendant’s attorney wants an extension of that deadline; and

- Defendant’s attorney asks Plaintiff’s attorney to agree to an extension.

If the Defendant’s attorney has been a jerk, of course the Plaintiff / Plaintiff’s attorney is much less likely to agree to an extension. If there is no such agreement, then Defendant’s attorney is faced with 2 choices: rushing to meet the deadline or scheduling a court hearing to seek a court order extending the deadline. Both of those are bad for the Defendant – congratulations, you just paid your attorney a few thousand dollars to attend a court hearing that most likely could have been avoided if the attorney hadn’t been a jerk – with no guarantee you’ll even get the extension.

There are many, many instances during a typical lawsuit in which the parties / their attorneys have the opportunity to cooperate, and almost always, each side will want one or more instances of cooperation from the other side. Handling such things cooperatively and without having to hold a court hearing is almost always better for all and is always less expensive.

Don’t Forget About The Stress And The Emotional Toll

We all know that feeling – just in regular life – when there is an email, phone call, mail item received, or even text message and we know (or think we know) it’s going to be hostile or about a stressful topic. Now, think about being in a lawsuit or some other legal dispute or in an intense contract negotiation and the stress that brings. Then, add the hostility / increased hostility factor which comes when your attorney is a jerk.

Each and every communication or development is more likely to be a stressful one, or have increased stress attached to it versus how it could have been. The emotional toll this takes (which attorneys are not immune from) can accumulate rapidly and have serious negative consequences in your life and in your case.

There is no doubt that acting like a jerk is usually a poor choice for an attorney. Attorneys should know (or learn) how to be tough without being a jerk, and they should steer their clients toward productive behavior as well.

Why Are Legal Agreements so Long and Complicated?

Most people (including business owners) want (or think they want) “just a very basic contract – 2 pages, not 10 pages”. There could be many reasons for this; they often include one or more of the following.

(1) They themselves want to be able to understand the contract.

(2) They think the legal fees for the agreement will be less expensive that way.

(3) They don’t want to “scare the other side away with an intimidating legal document.”

(4) On average, human beings have shorter and shorter attention spans and less desire and ability to focus on details – this includes some lawyers.

Of course, what a “basic contract” is varies from situation to situation and party to party.

Some contracts are longer than they need to be and more detailed than they need to be, with very little benefit to the extra content. However, most of the time the “details” which cause some to think the contract is “too long” are important *or could become important*.

Don’t drive without a seat belt, randomly hoping that everything goes perfectly – let the lawyer help you with common sense, reasonable protections.

Here are a few straight forward, real world examples of contract topics which many clients might assume are unnecessary, accompanied by reasons that content can be important and should be considered for inclusion. This is not an all-inclusive list.

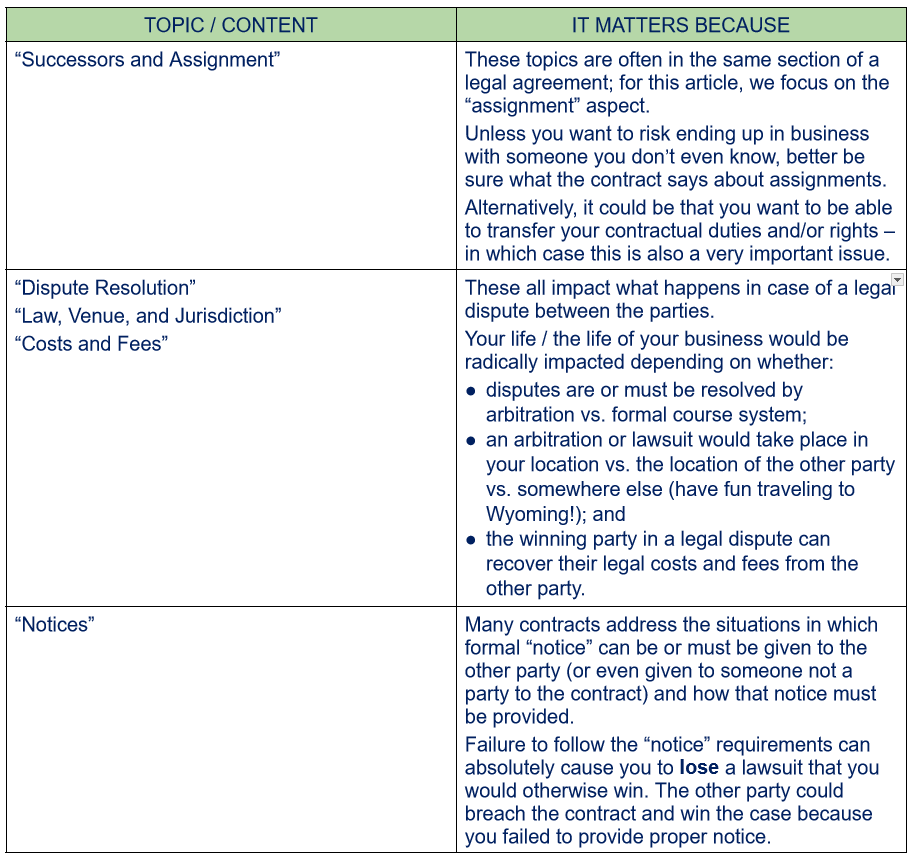

Business Contracts – Be Very Careful With Changes To Your Legal Agreements

One of the most frequent problems we business lawyers at McGrath & Spielberger encounter is when changes were made to a section of a legal agreement but the parties (or even their lawyers) failed to realize that said change should have resulted in other content being adjusted.

We sometimes call this a failure to harmonize the contractual changes, and further below are a few clear-cut, real world examples.

If you’re not an expert, or close to it, you’re not going to know enough to avoid these sorts of mistakes. We all have “swiss-cheese” knowledge (holes in our understanding), especially in fields which are not our own.

Just hire a sufficiently qualified professional to protect you by detecting and/or avoiding these sorts of mistakes in your business agreements.

x

x

Lease or License: What’s the Difference and Why Does it Matter? – Part Three

If you have not already, check out Part One and Part Two of this series.

It’s important to distinguish between the two arrangements as it will determine the rights and remedies of the licensee or tenant. Even if the agreement is titled as a ‘license,’ if it sounds like a lease, looks like a lease, and smells like a lease, then more likely than not, it is a lease and it will be enforced as such. Careful contract drafting should be utilized by commercial property owners (or their attorneys) looking to implement an effective and enforceable license regime.

For some, a license may be the best option for their business as they can operate at a lower cost versus having to rent. A prime example of this is beauty professionals using a salon suite rather than renting a chair in a beauty salon. Many salon suites come with the furniture and/or equipment needed by the beauty professional and allows them to operate with more independence and flexibility.

For others that wish to make themselves at home in their office, the security of a lease may be more appealing to you. If you’re a potential tenant/licensee looking for clarification of an agreement presented to you or a commercial property owner looking to draft a license agreement, contact our firm for assistance.

Lease or License: What’s the Difference and Why Does it Matter? – Part Two

By now you know the difference between a lease and a license from Part One of this series but what makes one option more favorable than the other? What are some disadvantages?

In the shared office space context, a licensee is granted permission to enter onto the licensor’s property to make use of an office, desk, or other space or equipment for the licnesee’s business within the hours agreed to.

Usage by way of a license can have several benefits for licensees, such as: (1) flexibility to terminate the license; (2) all-inclusive price on a cost-per-month basis, with such prices typically less than rental prices; and (3) the occupation period of the property is normally shorter.

Of course, some drawbacks include absence of long-term security for the licensee, the inability to alter the licensed space, and at-will revocation of such license. Therefore, a license agreement allows commercial property owners to eliminate the landlord-tenant relationship and avoid having to go through the traditional eviction proceedings should any issues arise.

Regardless of what the agreement might be called (the title does not have much legal significance), there are characteristics to look for to determine whether the arrangement appears to be more like a lease rather than a license: (1) whether the use will be exclusive; (2) the arrangement relates to a particular piece of real property (is it for an entire office or just a desk?); (3) whether the use will be for a specific period of time; and (4) whether such use is in exchange for regular monthly payment (pricing for licenses may change month-to-month).

Considering the advantages/disadvantages of a license versus a lease, you may be wondering what your legal rights and remedies are under both arrangements and how they differ. We’ll be covering the legal aspects in Part Three of this series.

Lease or License: What’s the Difference and Why Does it Matter? – Part One

With the boom in entrepreneurship in response to the COVID-19 pandemic, many entrepreneurs are attempting to navigate unfamiliar waters with regards to finding a location suited to their business needs. Since not all businesses are one-size-fits-all, many are discovering the perks of using shared office spaces through companies like WeWork and Workbar. However, many are being presented with a license agreement, rather than a lease, and aren’t sure of the difference and implications of such.

With the boom in entrepreneurship in response to the COVID-19 pandemic, many entrepreneurs are attempting to navigate unfamiliar waters with regards to finding a location suited to their business needs. Since not all businesses are one-size-fits-all, many are discovering the perks of using shared office spaces through companies like WeWork and Workbar. However, many are being presented with a license agreement, rather than a lease, and aren’t sure of the difference and implications of such.

A lease is a property interest or estate in real property that grants a tenant the right to exclusive possession of the property for their own use and enjoyment for a period of time in exchange for payment of rent. Most people are familiar with traditional leases, whether residential or commercial.

By contract, a license is a temporary right to use property for a specific purpose. A prime example of a license agreement is when you buy a ticket to a sporting event or concert – you are granted permission from the venue to occupy the seat or space for the purpose of attending the event. The permission ends when the license is revoked or the particular purpose is over or has been completed.

Whether one option is better than another depends on the particular business. The advantages and disadvantages as well as how to distinguish one from the other is further explored in Part Two of this series.

Comparison of Subchapter K v. Subchapter S

Both Subchapter K and S of the Internal Revenue Code (IRC) are pass-through tax structures in which the members of the entity are taxed for the entity’s income, gains, losses, and expenses on their individual tax returns. That is where the similarities end.

There are several differences discussed below that make Subchapter K seem more taxpayer friendly than Subchapter S. Much of the popularity of the LLC is attributable to the fact that LLCs offer limited liability to all investors combined with the more flexible partnership tax regime. In some situations, however, the goals of the business owners may be better achieved with an S corporation.

Subchapter S places very strict restrictions on the ownership and capital structure for S corporations. S corporations are limited to 100 shareholders (although members of a “family,” broadly defined, are counted as one shareholder), and they may not have more than one class of stock. Additionally, all shareholders much be individual U.S. citizens or residents and other corporations or partnerships cannot be shareholders of the company. Anyone can be a member or partner of an entity taxed under Subchapter K.

Partnerships and LLCs taxed under Subchapter K may make special allocations of income and deduction items, while shareholders of an S corporation must include corporate income and loss on a pro rata share basis. Thus, partners/members may agree to share certain income or deductions disproportionately, and the agreement will be respected for tax purposes if it reflects their economic business deal. Additionally, in most cases, partnerships and LLCs taxed under Subchapter K, can distribute appreciated property in kind without immediate recognition of taxable gain.

In a business with only a few owners, an S corporation may be the entity of choice because the flexibility of Subchapter K is not needed. S corporations are often used by owners that prefer to conduct their business as a state law corporation instead of a partnership or limited liability company because they are more comfortable with the corporate governance structure. S corporations are also often used by service providers to minimize their exposure to employment taxes. S corporations are not viable options in many situations – a business with foreign investors would not be able to make the S corporation election because foreign investors are not permissible S corporation shareholders. Additionally, many institutional investors (e.g., tax-exempt pension funds and charitable organizations) are discouraged by the tax system from investing in any type of active business that is operated as a pass-through entity. Venture capital funds, which provide a large source of capital for start-up companies, appear to be more comfortable using the familiar C corporation capitalized with several classes of stock, a structure not available in an S corporation.

For a complete analysis of the tax implications of C Corporations, Partnerships, and S Corporations click here for the Joint Committee on Taxation’s publication entitled “Choice of Business Entity: Present Law and Data Relating to C Corporations, Partnerships, and S Corporations.”

Contact us regarding your business law matter. Click here

Registered Agent for your North Carolina Business – Can you be your own Registered Agent?

This is one of a series of articles by our law firm on the topic of registered agents. For more articles on this topic, click here to access the “Registered Agent” category of articles, or select a title below.

-

Registered Agent for your North Carolina Business – What your Mandatory Registered Agent Does

-

Registered Agent for your North Carolina Business – Who Can be the Registered Agent

More articles coming soon!

First, whose Registered Agent are we referring to? We’re talking about a corporation or a limited liability company, so we mean the business entity you might own or manage, and the legal requirement in North Carolina that it have a Registered Agent (all sometimes called an “RA”).

Second, what “you” are we referring to when we ask about eligibility to be the RA? The answer to this question makes a big difference.

Can an owner, shareholder, member, or officer of a corporation or limited liability company be the RA for that business entity? Yes, as long as they reside in NC and their business address is identical to the registered agent office listed.

Can a staff member or “regular employee” of a corporation or limited liability company be the RA for that business entity? Yes, as long as they reside in NC and their business address is identical to the registered agent office listed.

Can someone not affiliated with the corporation or limited liability company in any other way be the RA for the business entity? Yes, as long as they reside in NC and their business address is identical to the registered agent office listed.

Can a corporation or business entity serve as the RA for itself? Apparently not. Interestingly, North Carolina’s statutes do not appear to directly rule this out. However, we have witnessed instances in which the NC Secretary of State has rejected attempts by business entities to do this. You can argue both sides of the question, but unless the North Carolina Secretary of State’s office changes its position (voluntarily or due to a court ruling), if you want a corp. or LLC to be your Registered Agent, it will need to be a properly qualified different corp. or LLC as your Registered Agent.

The bottom line: it’s vitally important to have a Registered Agent who is compliant and reliable.

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by clicking here or calling us at 800.481.2180.)

Registered Agent for your North Carolina Business – Who Can be the Registered Agent

This is one of a series of articles by our law firm on the topic of registered agents. For more articles on this topic, click here to access the “Registered Agent” category of articles, or select a title below.

-

Registered Agent for your North Carolina Business – What your Mandatory Registered Agent Does

- Registered Agent for your North Carolina Business – Can you be your own Registered Agent?

More articles coming soon!

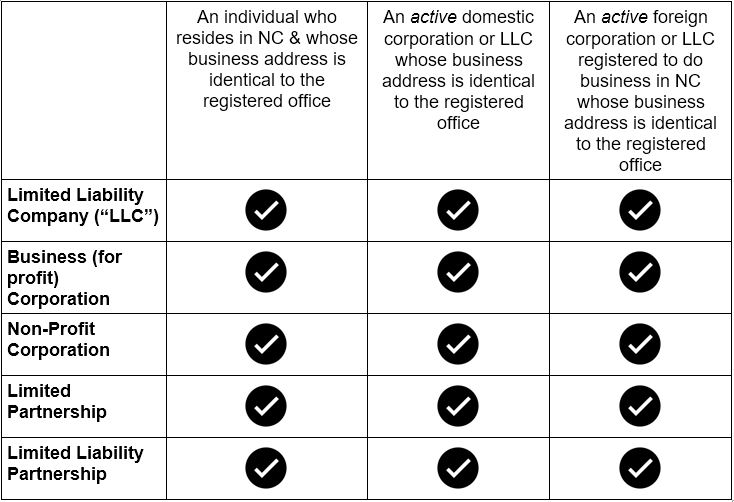

Who / what can be the Registered Agent for a business in North Carolina?

See further down past the table for additional information and clarifications.

Can you “be your own RA”? Stayed tuned for our next article to find out.

Are the laws / rules summarized above the same for “domestic” North Carolina LLCs and corporations as well as “foreign” LLCs and corporations registering or registered in NC? Yes.

The table above says that if the RA is an LLC or a corporation, it has to be an “active” one – what does that mean? This is best interpreted to mean that the LLC or corporation serving as Registered Agent itself must be (and remain) in good standing with the North Carolina Secretary of State Corporations Division. For example, the LLC or corporation serving as Registered Agent should NOT be or become administratively dissolved or under a state of suspension due to tax issues with the North Carolina Department of Revenue.

Does this mean my company can be its own Registered Agent? Great question! Click here to read about that.

Does this mean I, as an owner, officer, and/or manager can be the Registered Agent? Maybe, but even when the answer is “Yes”, that may not be the best idea. Click here for more information.

What about the reference to the “registered office”? Click here to understand the Registered Office requirements.

Are these laws / rules the same for all of North Carolina? Yes. The laws and rules on this issue are the same whether your business or Registered Agent is located in Ashville, Boone, Cary, Charlotte (or anywhere else in the “Great State of Mecklenburg”), Durham, Fayetteville, Greensboro, Raleigh, Wilmington, or any point in between in our State.

The consequences of not having a Registered Agent or not having a legally compliant RA will be explored in another article, but suffice it to say that your LLC, corporation, or other relevant business entity can suffer significant loss of legal rights and even end up with a court order, judgment, or other legal decree against it.

The bottom line: it’s vitally important to have a Registered Agent who is compliant and reliable.

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by clicking here or calling us at 800.481.2180.)

Registered Agent for your North Carolina Business – What your Mandatory Registered Agent Does

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by clicking here or calling us at 800.481.2180.)

(In case you were wondering, yes, our law firm does serve as a registered agent in both North Carolina and South Carolina, feel free to reach out to us if you’d like to know more by clicking here or calling us at 800.481.2180.)

We break this short, user-friendly article down into two (2) sections: the legalities and the practicalities.

THE LEGALITIES

By way of North Carolina law, a Registered Agent (sometimes referred to as the “RA”) can be served with “service of process, notice or demand required or permitted by law to be served on an entity”. The entity being referred to here will be one of the following business entities registered with / on file to do business in N.C.:

(A) a domestic (North Carolina) business corporation, nonprofit corporation, limited liability company, limited partnership, or limited liability partnership; or

(B) a foreign corporation, nonprofit corporation, limited liability company, limited partnership, or limited liability partnership.

Thus, a Registered Agent’s primary legal duty is to receive any of the items listed above which can be served on a North Carolina LLC, corporation, or other business entity via the RA. This is true regardless of whether your business or Registered Agent is located in Asheville, Boone, Cary, Charlotte (or anywhere else in the “Great State of Mecklenburg”), Durham, Fayetteville, Greensboro, Raleigh, Wilmington, or any point in between in our State.

THE PRACTICALITIES

We lawyers at McGrath & Spielberger know that sometimes attorneys – to the detriment of their clients – don’t focus enough on the practical aspects of doing business and the day-to-day, real world ways in which the law impacts businesses and business owners. Let’s not fall into that trap – instead let’s go ahead and discuss some key practical and logistical factors relating to Registered Agents in North Carolina.

• What’s the #1 quality you need in a Registered Agent? Reliability.

• Why? Because, practically, if that Registered Agent doesn’t effectively process any of those notice-type items which it receives, you may have a problem.

• Your RA needs to get you these items to you immediately, in full, and preferably via multiple methods.

The consequences of not having a reliable RA will be explored in another article, but suffice it to say that your LLC, corporation, or other relevant business entity can suffer significant loss of legal rights and even end up with a court order, judgment, or other legal decree against it if your RA isn’t effectively and efficiently handling its duties.

The bottom line: it’s vitally important to have a Registered Agent who is compliant and reliable.

This is one of a series of articles by our law firm on the topic of registered agents. For more articles on this topic, click here to access all the “Registered Agent” category of articles or select a title below.

How Do You Expand Your Company Into North Carolina From Another State?

Option 1: keep your South Carolina LLC open and register it with the State of North Carolina as a foreign business authorized to transact in North Carolina. You’d obtain a “Certificate of Good Standing” or similar from Florida. You then provide that to the Secretary of State for North Carolina as part of your North Carolina Application for Certificate of Authority (to conduct business in North Carolina). Assuming you are approved by NC, you’re now good to go to conduct business in both states, or either state, and you can have your principal place of business in either state. You will likely be required to pay annual fees to each state and file taxes in each state, which are important factors to consider.

Option 2: start an affiliated company or subsidiary in North Carolina. In certain specific instances, you may keep your South Carolina LLC open, and instead of registering it with North Carolina, you’d prefer to create and register a separate but related business entity in North Carolina. This is typically referred to as a “subsidiary” or an “affiliated company”. You will likely be required to pay annual fees to each state and file taxes in each state, which are important factors to consider.

Additional notes. Under any of the above options, you’ll have to have a registered agent with a “continuous presence” in NC. Many law firms (like mine) agree to provide that service for a small annual fee, but your company’s “RA” doesn’t have to be a business lawyer or law firm. Of course, we also provide the very services needed to transfer your business overall.

These actions can be accomplished without an attorney, but you should at least consider consulting with an attorney any time you make a significant change to your business entity. Good luck!

Carolina Contracts: Contractual “Recitals”

Here are some of the key points contained in the video:

• Recitals often follow the introductory paragraph of a contract.

• Recitals can play a very important role later on if there is a lawsuit.

• Recitals often show the purpose of a contract.

• Be careful and make sure the Recitals contain proper information.

If you have a contract matter in North Carolina, South Carolina, Georgia, Florida or Tennessee, we invite you to fill out our confidential potential client intake form.

North Carolina Charitable Solicitation License: Does Your Non-Profit Need One?

Over the past several weeks, I’ve spoken with several different non-profit creators that were surprised to hear that their organizations would need a charitable solicitation license in connection with their fundraising efforts.

If an organization or individual asks the public for contributions and/or donations to help, aid, or otherwise support a charitable purpose, a charitable solicitation license is needed.

What is considered a “contribution?” A “contribution” means a promise, pledge, grant of any money or property, financial assistance, or any other thing of value in response to a solicitation (including in-kind contributions or goods or services).

Is my organization exempt from this license requirement? North Carolina General Statute 131F-3 provides for a number of statutory exemptions from the license requirement. A careful review of the statute should be conducted to see if your organization would qualify for such. To obtain an exemption, your organization would need to submit a written request with supporting documentation to the North Carolina Secretary of State Charities Division.

My organization isn’t exempt. What do I need to do now? If your organization does not qualify for a statutory exemption, license applications can be completed online using the Charities Division’s online filing portal.

How much is the filing fee? The license application fees are statutorily set under North Carolina General Statute 131F-8. The fees are set based on the contributions received per fiscal year.

What do I need to do every year to keep my license active? The organization will need to file a renewal application every year to keep the license active. The renewal application is due four and a half (4 ½) months after the organization’s year-end, which is the same filing deadline as the IRS Form 990.

What are the potential penalties if I fail to obtain the license? Failure to comply with the charitable solicitation license statutory requirements can result in civil and criminal penalties such as an administrative penalty up to $1,000 per act or omission which constitutes a violation, a civil penalty up to $10,000 per violation, and a criminal charge of a Class 1 misdemeanor.

What if my organization solicits contributions in other states? Many other states have some version of a charitable solicitation license and filing requirements. If your organization is soliciting funds in other states, you should speak with an attorney licensed in that state to determine if it is necessary for your organization to file in that state.

Arbitration Fees – How Much do Arbitrators Cost?

Business law Attorney Jason McGrath shares some information about how much you should expect to pay in fees to an Arbitrator in this short video.

Here are some of the key points contained in this informational video:

- Arbitrators typically charge fees similar to what lawyers charge.

- Does the Arbitrator require a minimum amount when the arbitration is scheduled? This may be called a cancellation fee or a retainer fee. The arbitrator may require this to offset a loss if the arbitration cancels.

- Arbitrators can sometimes be bargained with to lower fees but normally these are set fees.

- Arbitration fees (which are mostly made up of the Arbitrator’s fees) are often split evenly between the parties, but this can be altered by contract, law, or court order.

You should get advice from an attorney to assist in handling litigation issues like arbitration.

This is part of a continuing series of video blogs on contract law and arbitration – you can find the first part of this series on our blog or on our YouTube Channel.

If you need legal services in North Carolina, South Carolina, Georgia, Florida, Ohio, or Tennessee we invite you to fill out our confidential client form for possible legal assistance.

Arbitration: How Do You Choose The Arbitrator?

Here are some of the key points contained in the video:

- If using a panel of 3 arbitrators: each party picks an arbitrator and then those two arbitrators pick the third one.

- If using only 1 arbitrator: one side presents a list of possible arbitrators to the other side and the other side picks from the list.

- You go back and forth and negotiate between the parties until a decision is made.

- You may wish to avoid attempting private conversations with potential arbitrators in order to avoid the appearance of impropriety.

- Consider all the information available to you to make an informed decision about your arbitrator.

- Arbitrators may also be appointed by the court.

If you need legal services in North Carolina,

South Carolina,

Georgia,

Florida,

Ohio,

or Tennessee we invite you to fill out our confidential client formfor possible legal assistance.

Loan Agreements: Include Attorney Fees & Costs

Here are some of the key points contained in the video:

• DON’T EVER lend someone money without a written agreement

• DON’T EVER create a loan without including an Attorney Fees, Court Costs and Collection Costs provision.

• In most North Carolina cases, it is difficult to collect attorney fees and collection costs unless it is specifically stated in the written contract.

• What if the loan borrower does not repay the loan?

1. The lender could spend thousands of dollars in costs and fees, not to mention time invested, with no guarantee of ever collecting the money owed.

2. If obtained, a judgment will need to be enforced against the borrower, resulting in additional expenses for the lender.

3. For lawsuits by a business entity to collect on a loan, attorney representation is required, because individuals cannot represent themselves.

If you need legal services in North Carolina, South Carolina, Georgia, Florida, or Tennessee we invite you to fill out our confidential potential client form.

Arbitration Clauses and Costs + Fees

Here are some of the key points contained in the video:

1. Should attorney fee and legal costs provisions be included in an arbitration clause? Examples of options:

A. Arbitration is required, but attorneys’ fees and legal costs are specifically not allowed to be recovered by the prevailing party

B. Prevailing party can recover its attorneys’ fees and legal costs from the non-prevailing party

C. The arbitrator has discretion on these issues..

2. Consider which party is more at risk of being sued and which party has more resources.

Does the type of attorney fee being charged influence these drafting decisions?

If considering a legal agreement presented to you, you should have your attorney take a look at the contract and then make a careful decision on how to proceed based on a thorough legal analysis of your situation and the proposed contract.

If you need legal services regarding contracts, business law matters, or other matters we handle in North Carolina, South Carolina, Georgia, Florida, or Tennessee, we invite you to fill out our confidential potential client intake form.

North Carolina Premises Liability Law: What Are Your Responsibilities as a Landowner?

When someone visits your property – whether as a social guest or a repairman – there is always a chance that an injury could result. As a landowner, you may not know the extent of your potential liability when someone becomes injured on your property.

Some states, such as Florida, apply different standards of care on the part of the landowner depending on the classification of the injury person (invitee, licensee, or trespasser). Up until 1998, North Carolina courts did so as well. Now, North Carolina applies the same standard of care of landowners to all lawful visitors – landowners must exercise reasonable care in not exposing lawful visitors to dangerous conditions and must warn of any hidden dangers on the property. “Reasonable care” may mean cleaning up a spill on the floor or just maintaining the property in general.

In order to recover damages from a landowner, the visitor must prove that the landowner negligently caused the condition or failed to remedy the condition after the landowner knew or should have known of the condition’s existence. With regards to hidden dangers, a landowner is required to give an adequate warning of the danger’s existence – this could mean a natural condition (ex/ a hill) or an artificial condition (ex/ a swimming pool).

It is important to remember that the above standard of care is for lawful visitors. For unlawful visitors, a landowner’s duty is only to refrain from willfully harming the trespasser. However, there is a particular doctrine – the attractive nuisance doctrine – that allows a landowner to be held liable for injuries sustained by children who trespass on the landowner’s property if the dangerous condition was one likely to attract children.

Common types of premises liability lawsuits include:

(1) “Slip and Fall” – these cases commonly occur on commercial properties, such as a restaurant or grocery store. There are several issues that can arise in these cases – How long was the dangerous condition (i.e., the spill or liquid) present? Was a warning present (i.e., one of those yellow “Caution” signs)?

(2) Property Defects – these cases can involve injuries resulting from a broken railing or broken stairs.

(3) Dog Bites – a landowner may be liable for any injuries that his or her dog causes if the dog had shown dangerous tendencies in the past and the landowner (and dog owner) had knowledge of these tendencies at the time of the injury.

There are certain situations in which a landowner may defensibly raise the doctrine of contributory negligence, which bars recovery by the injured party if they are partially at fault. This could mean that the visitor did not properly look where they were going or failed to act reasonably at the time they became injured. Imagine a visitor going downstairs to your basement without turning the lights on and then tripping on the stairs.

Florida Residential Landlord Rights and Responsibilities: What You Need to Know Before You Buy That Investment Property

Landlord/tenant laws cover rights and responsibilities each tenant and landlord has in their specific state. Because Florida is one of the best states in the country to invest in property, you may be considering buying an investment property. Before you do, you should understand Florida rental laws and consider certain aspects to better protect yourself and your investment, especially in the time of COVID-19.

Landlord/tenant laws cover rights and responsibilities each tenant and landlord has in their specific state. Because Florida is one of the best states in the country to invest in property, you may be considering buying an investment property. Before you do, you should understand Florida rental laws and consider certain aspects to better protect yourself and your investment, especially in the time of COVID-19.

I’m worried about damage to my property. What can I do to better protect myself and my investment?

So, you are concerned that your prospective tenant may cause damage beyond normal wear and tear. Or maybe you have concerns about your tenant’s financial situation. Luckily, there is no statutory cap on a security deposit amount in Florida and you are able to charge the deposit at your own discretion. Typically, Florida landlords charge the equivalent of a month’s rent. However, if you have concerns about your property or your tenant, you can charge more than that. While there is no limit, landlords will likely charge no more than two months’ rent. You should understand that charging an excessive security deposit may turn away prospective tenants so just be prepared for that.

What repairs am I required by law to make and what repairs can I hold the tenant responsible for?

You are legally required to keep the property “livable.” Under the doctrine of implied warranty of habitability, a landlord must maintain the structure of the building (stairs, ceiling, floors, etc. safety), provide hot/cold water, provide trash receptacles, exterminate bugs and rodents, etc. Therefore, maintenance and repair of any of those would be required.

On the other side, there are other repairs that you would not be required to fix by law, such as leaky faucets, grimy grout, and squeaky cabinet doors. Your obligations versus your tenant’s obligation to make these minor repairs should be addressed in the lease. I’ve commonly seen leases that require the tenant to pay for minor repairs and specify the price minimum for what constitutes as a ‘major’ repair. This means that, if the cost of a repair is less than the minimum amount of the major repair, you can require the tenant to make and pay for the repair.

The AC broke in my property. Do I have to repair or replace it?

Surprisingly, Florida law does not require landlords to provide or repair air conditioning. Rather, landlords are required, by statute, to provide functioning heat during the winter. However, most landlords do provide other appliances outside of just heat, such as air conditioner, ovens, refrigerators, etc. Therefore, the only instance in which you as a landlord would be responsible for repairs to additional appliances is if those repairs were included in the lease.

My tenant is claiming that I failed to repair a hazardous condition and is now threatening to withhold rent. Is this allowable?

Yes, however, the tenant must meet strict requirements. Under the previously mentioned doctrine of implied warranty of habitability, the landlord is required by law to make sure that the property is free of any hazardous or dangerous conditions. If you fail to repair the condition, the tenant has the option to either: (1) remain in the property and withhold rent until you fix the condition; or (2) move out and terminate the lease.

If the tenant seeks to remain in the property and withhold rent, the tenant:

• Must provide notice – the tenant must provide written notice to you of their intent to withhold rent at least 7 days before the rent is due. They may either hand deliver it or send the notice by certified mail. If mailed, the notice must be sent at least 12 days before the rent is due. After receiving the notice, you have 7 days to make repairs;

• Must be current in rental payments;

• Has the right to withhold all future payments – as long as the tenant follows the correct procedure, they have the right to withhold all future rental payments until the repair is completed.